Having life insurance coverage offers several significant benefits for individuals and their families. Firstly, life insurance provides financial security by offering a death benefit to beneficiaries upon the policyholder’s passing. This lump-sum payment can help cover funeral expenses, outstanding debts, mortgage payments, and everyday living expenses, ensuring that loved ones are not burdened financially during a difficult time.

Secondly, life insurance provides peace of mind, knowing that loved ones will be protected financially in the event of the policyholder’s death. It allows individuals to plan for the future with confidence, knowing that their family’s financial well-being is safeguarded.

Additionally, life insurance can serve as an income replacement tool, particularly for breadwinners or primary earners in a household. The death benefit can help replace lost income, allowing surviving family members to maintain their standard of living and pursue their financial goals.

Moreover, life insurance can be used as a tool for estate planning and wealth transfer. It can help cover estate taxes, provide liquidity to the estate, and ensure that assets are distributed according to the policyholder’s wishes.

Furthermore, some life insurance policies offer living benefits, such as cash value accumulation or access to funds for emergencies or financial opportunities during the policyholder’s lifetime.

Overall, having life insurance coverage offers financial protection, peace of mind, income replacement, estate planning benefits, and potential living benefits, making it a valuable tool for individuals and their families to secure their financial futures.

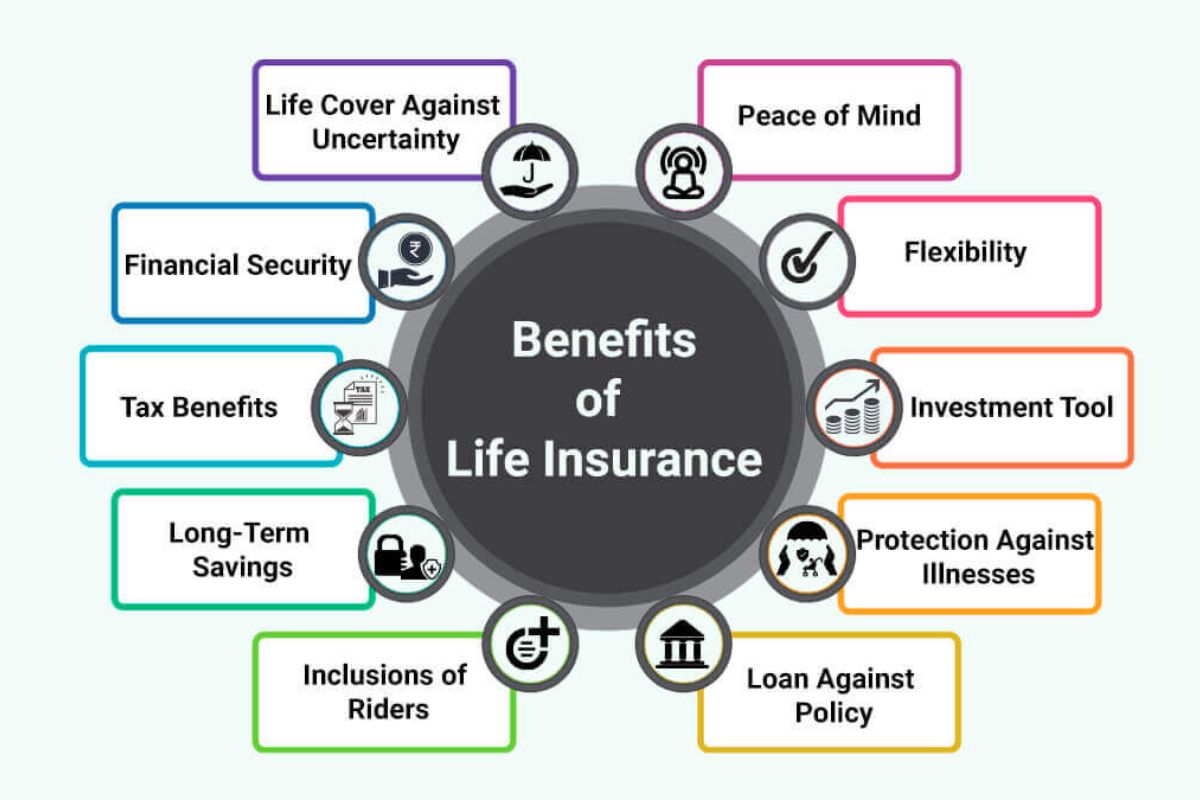

What are the life insurance benefits?

Life insurance provides several benefits to policyholders and their beneficiaries:

Financial Security.Life insurance offers a death benefit to beneficiaries upon the policyholder’s passing. This lump-sum payment helps cover funeral expenses, outstanding debts, mortgage payments, and everyday living expenses, providing financial security to loved ones.

Peace of Mind. Knowing that loved ones will be financially protected in the event of the policyholder’s death brings peace of mind. It allows individuals to plan for the future with confidence, knowing that their family’s financial well-being is safeguarded.

Income Replacement. Life insurance serves as an income replacement tool, particularly for primary earners in a household. The death benefit can help replace lost income, allowing surviving family members to maintain their standard of living and pursue their financial goals.

Estate Planning.Life insurance can be used as a tool for estate planning and wealth transfer. It can help cover estate taxes, provide liquidity to the estate, and ensure that assets are distributed according to the policyholder’s wishes.

Living Benefits.Some life insurance policies offer living benefits, such as cash value accumulation or access to funds for emergencies or financial opportunities during the policyholder’s lifetime.

Overall, life insurance provides financial protection, peace of mind, income replacement, estate planning benefits, and potential living benefits, making it a valuable tool for individuals and their families to secure their financial futures.

Life coverage advantages.

Life insurance coverage offers several advantages to policyholders and their beneficiaries:

Financial Protection. Life insurance provides a death benefit to beneficiaries upon the policyholder’s passing. This lump-sum payment can help cover funeral expenses, outstanding debts, mortgage payments, and everyday living expenses, ensuring that loved ones are financially secure during a difficult time.

Income Replacement. For families reliant on the policyholder’s income, life insurance serves as an essential income replacement tool. The death benefit can help replace lost income, allowing surviving family members to maintain their standard of living and meet financial obligations.

Debt Repayment. Life insurance can be used to pay off outstanding debts such as mortgages, loans, and credit card balances, relieving financial burdens for beneficiaries and ensuring that assets are not depleted to cover debts.

Estate Planning. Life insurance facilitates estate planning by providing liquidity to the estate. It can help cover estate taxes, legal fees, and other expenses associated with settling the estate, ensuring a smooth transfer of assets to beneficiaries.

Business Continuity. In business partnerships or ventures, life insurance can ensure continuity by providing funds to buy out a deceased partner’s share or to cover expenses during a transition period, protecting the business and its stakeholders.

Legacy and Charitable Giving. Life insurance allows policyholders to leave a lasting legacy by designating beneficiaries or charitable organizations to receive the death benefit. It provides a means to support causes and leave a positive impact beyond one’s lifetime.

Potential Living Benefits. Some life insurance policies offer living benefits, such as cash value accumulation or access to funds for emergencies or financial opportunities during the policyholder’s lifetime, providing additional financial flexibility and security.

Overall, life insurance coverage provides financial protection, income replacement, debt repayment, estate planning benefits, business continuity, and opportunities for charitable giving and legacy building, making it a valuable tool for individuals and families to secure their financial futures.

What is the insurance protection benefits .

Insurance protection benefits refer to the various advantages and safeguards provided by insurance policies to policyholders and their beneficiaries. These benefits typically include:

Financial Security.Insurance protection offers financial security by providing coverage for unexpected events or losses. This can include reimbursement for property damage, medical expenses, liability claims, or loss of income due to disability or death.

Risk Mitigation.Insurance helps mitigate risk by transferring the financial consequences of potential losses from the policyholder to the insurance company. This allows individuals and businesses to protect themselves against unforeseen events that could otherwise have significant financial implications.

Peace of Mind.Knowing that one is protected by insurance provides peace of mind, reducing anxiety and worry about potential financial hardships resulting from accidents, illnesses, or other adverse circumstances.

Legal Protection.Insurance policies often include legal protection benefits, such as coverage for legal expenses or liability claims. This can help policyholders navigate legal proceedings and defend themselves against lawsuits or legal disputes.

Asset Protection. Insurance can help protect valuable assets, such as homes, vehicles, businesses, and personal belongings, from loss or damage. By providing coverage for repairs, replacements, or compensation for lost or stolen assets, insurance helps safeguard the financial investments of policyholders.

Lifestyle Maintenance. In the event of a covered loss or unexpected event, insurance protection benefits can help policyholders maintain their current lifestyle by providing financial support for necessary expenses, such as medical treatments, home repairs, or living expenses.

Business Continuity. For businesses, insurance protection benefits can ensure continuity in the event of unexpected disruptions, such as property damage, liability claims, or the death or disability of key personnel. This helps businesses recover and resume operations more quickly after a setback.

Overall, insurance protection benefits provide financial security, risk mitigation, peace of mind, legal protection, asset protection, lifestyle maintenance, and business continuity, making insurance a valuable tool for individuals, families, and businesses to manage and mitigate various risks and uncertainties.

Policy perks.

Policy perks refer to the additional benefits or advantages offered by insurance policies beyond the basic coverage. These perks are designed to enhance the value of the policy and provide added convenience, protection, or financial benefits to the policyholder. Some common policy perks include:

Accident Forgiveness. Auto insurance policies may offer accident forgiveness, which means that the policyholder’s premium rate will not increase after their first at-fault accident.

Rental Car Reimbursement. Some auto insurance policies include rental car reimbursement coverage, which helps cover the cost of renting a vehicle while the insured car is being repaired after a covered accident.

Roadside Assistance. Many auto insurance policies offer roadside assistance services, such as towing, tire changes, and fuel delivery, to help policyholders when they experience car trouble on the road.

Discounts. Insurance companies may offer various discounts to policyholders, such as multi-policy discounts for bundling different types of insurance, safe driver discounts, or discounts for installing safety devices in the insured property.

No-Claim Bonus. In some insurance policies, policyholders receive a no-claim bonus or discount on their premium if they do not make any claims during a certain period.

Annual Health Check-ups.Some health insurance policies include coverage for annual health check-ups or preventive screenings to help policyholders maintain their health and detect potential medical issues early.

Wellness Programs. Certain health insurance policies offer wellness programs or incentives to encourage healthy behaviors, such as gym memberships, discounts on healthy food purchases, or rewards for participating in fitness activities.

Home Maintenance Services. Some homeowners insurance policies provide access to home maintenance services, such as plumbing or electrical repairs, to help policyholders address minor issues before they become major problems.

Identity Theft Protection. Certain insurance policies offer identity theft protection services, such as credit monitoring, identity theft resolution assistance, and reimbursement for expenses related to restoring one’s identity.

Travel Assistance. Travel insurance policies may include travel assistance services, such as emergency medical assistance, legal assistance, or travel concierge services, to help policyholders during their trips.

These policy perks can vary depending on the insurance provider and the specific policy terms. It’s essential for policyholders to review their insurance policies carefully to understand what additional benefits or perks are included and how they can take advantage of them.

(Frequently Asked Questions)

Who Really Needs Life Insurance?

Life insurance is crucial for individuals with financial dependents, such as spouses, children, or aging parents. It provides financial protection to ensure loved ones are supported after the policyholder’s death. Even those without dependents can benefit, covering final expenses and leaving a legacy or supporting charitable causes.

What Are 3 Things Life Insurance Covers?

Life insurance covers three main things:

Death benefit. Provides a lump-sum payment to beneficiaries upon the policyholder’s passing to cover expenses like funeral costs, debts, and living expenses.

Income replacement. Helps replace lost income for beneficiaries, ensuring financial stability.

Estate planning. Facilitates wealth transfer and covers estate taxes.

What Are the Main Benefits of Life Insurance?

The main benefits of life insurance include financial security for loved ones through a death benefit, income replacement for beneficiaries, and assistance with estate planning. It provides peace of mind, ensures financial stability for dependents, and helps cover final expenses, debts, and estate taxes.

Who benefits from life cover?

Life cover benefits the policyholder’s beneficiaries, including spouses, children, or other dependents. It provides financial security and stability in the event of the policyholder’s death, ensuring that loved ones are supported and can maintain their standard of living, cover expenses, and achieve long-term financial goals.